Posts

This makes it a place for committing to rental properties2. Chicago’s an excellent savings, affordable housing, and you can large lease demand allow it to be a great a home market4. Even with current changes in the marketplace, Chicago’s a home world gets stronger1.

- But not, it’s critical for first-time buyers so you can conduct comprehensive marketing research, comprehend the regional possessions legislation, and you will cautiously assess their financial skill and you will chance tolerance.

- Whenever we has approved the loan, we need to buy an appraisal or a great CMA review and also the cost is born ahead of examination.

- Per area has some other degrees of request and you can income possible.

- Sure, but not, as mentioned before, we yes strongly recommend such purse from using in order to more capable or local traders to those portion.

Appeals judge allows Trump continue National Guard soldiers in the Los angeles

It’s vital that you assemble many of these documents beforehand and you will keep them structured and able to yield to the lending company. This helps streamline the mortgage process and increase the probability of acceptance. Instead of old-fashioned banking institutions, hard money lenders Chicago, including HardMoneyMan.com LLC, provide economic choices designed to each debtor’s private demands and you will issues. Tough Money Lenders Chicago typically approve difficult currency loan applications within months, sometimes times, which is specifically beneficial whenever competing for a while sensitive options such as a distressed property.

Real estate market

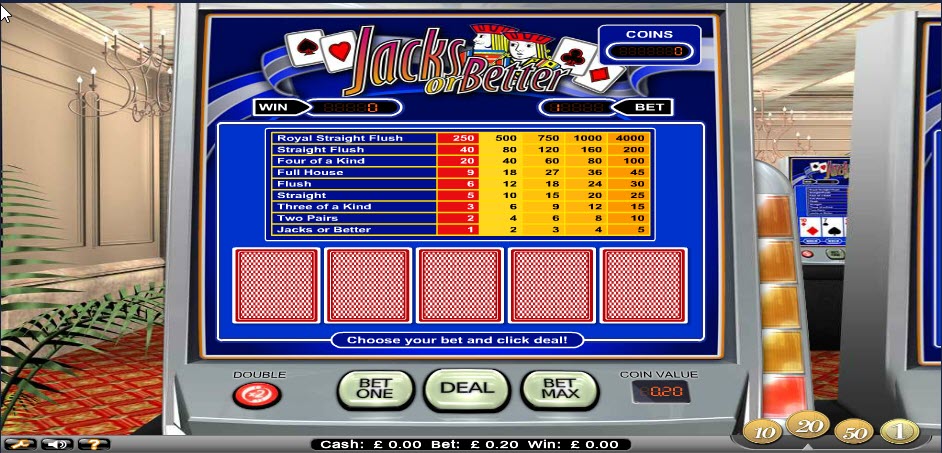

At the time of August 2024, the fresh median family really worth inside the Chicago is roughly $3 hundred,000, centered on Davinci Diamonds 150 free spins reviews analysis out of Zillow. This is notably below cities such New york, in which the median house really worth is all about $755,100, and you will La, and that really stands at around $942,000, according to Zillow. An economic coach can help you arrange for a primary money, for example to shop for a house. Serious money is fundamentally a believe percentage which shows the fresh vendor that you’re intent on to find their property. Very as an example for many who shell out 5% inside the earnest currency (abbreviated while the EM) as well as your overall deposit is 20% following which means you have already paid back 5% of the deposit up front.

Chicago’s Tough Loan provider

Based on DBusiness Mag, a Detroit organization publication, it provides an excellent trampoline playground, a good waterfall, a 2 hundred-ft “lazy river,” and you can an enchanted forest. You to definitely june at the a good raucous meeting regarding the Park Area headquarters, next to the Ac Nielsen Golf Heart, a posse out of infuriated dog-park profiles spoke out. At the same time, Ishbia’s family-design plans were beginning to impact the area. The fresh citizens of 1 nearby home, unlike has the view of Lake Michigan blocked, decided to disperse, attempting to sell a great $5 million villa which have eight bathrooms and you can 18-ft window.

Backers of Chicago a home transfer income tax walk aim to get measure to help you voters; money manage struggle homelessness

The brand new Connecticut DMV lets people to locate to towed vehicles in order to retrieve products that are essential to their health insurance and passions. However, individuals have forgotten performs gadgets, baby car seats, crucial data files and you will priceless mementos. ProPublica try a great nonprofit newsroom intent on nonpartisan, evidence-dependent news media one to keeps strength guilty. That have eight Pulitzer Prizes and you will reforms sparked inside the condition and you may local governing bodies, enterprises, establishments and much more, the revealing means that people attention arrives basic.

- As among the greatest difficult money lenders inside Chicago, we focus on investors each day that searching for foreclosures opportunitites.

- We now merely provide to your non-owner-filled unmarried loved ones, 2,step three,4 devices, town property, multi family, and some commercial functions.

- Simultaneously, Chicago’s numerous neighborhoods render a selection of money potential.

- It’s got steady rental request and you may potential for people inside unmarried-family home and you may rental features.

The present day import taxation speed is actually 0.75 per cent, no matter rate. Offer Chicago House do reconstitute they to your about three tiers. It could dive to dos percent to own conversion anywhere between $1 million and you may $step 1.5 million, while you are ascending to three percent for deals more than $step 1.5 million.

Yes to own DSCR and you can financing so you can thinking more than 65%For our In house finance, we influence the newest immediately after fixed worth (ARV) of one’s subject possessions playing with an aggressive field research or comparative field research (CMA). The fresh CMA uses ended up selling listings on the Mls to decide the fresh projected immediately after repaired really worth (ARV). The brand new comps used in the newest CMA will be out of equivalent characteristics when it comes to proportions, decades, position, construction, etc. inside a distance out of 0.5 miles on the topic possessions having ended up selling inside earlier step 3-one year. Specific gave a lower, even if still possible, risk of a taxpayer prevalent inside saying a loss centered on financing you to a lender agreed to forgive.